JCCU and its Community-Based Co-op Members' FY2024 Business Interim Report

2025.03.12

JCCU has announced the business overview for its community-based consumer co-ops nationwide from April to November 2024 and JCCU from April to December 2024 as follows:

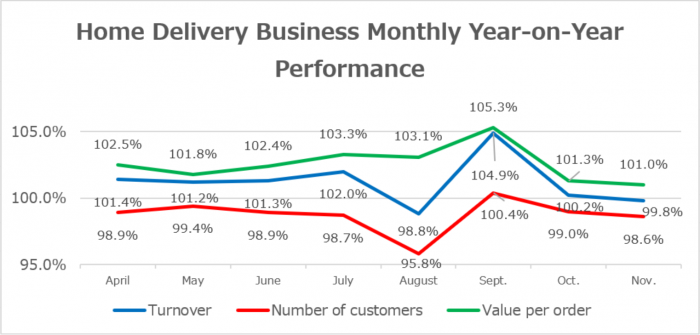

Home Delivery Business: The turnover exceeded the previous year's level due to rising product unit prices caused by inflation. The number of users and purchased items are showing signs of recovery.

The turnover of the home delivery business for community-based consumer co-ops nationwide from April to November 2024 exceeded that of the same period in the previous year. The order volume increasing by 1.2% year-on-year (hereinafter y/y) (101.2% y/y). Although the number of users (98.7% y/y) and purchased items (98.4% y/y) are showing signs of recovery, the rise in product unit prices (102.5% y/y) due to inflation continues to have an impact.

To enhance profitability, JCCU regularly held standardization seminars for home delivery centers to improve operational efficiency. Additionally, JCCU introduced AI technology to optimize home delivery route planning, reducing driving distances and streamlining course creation tasks.

Furthermore, to attract younger generations to join co-ops, JCCU launched the "TRY CO・OP" website, allowing potential members to experience home delivery services firsthand.

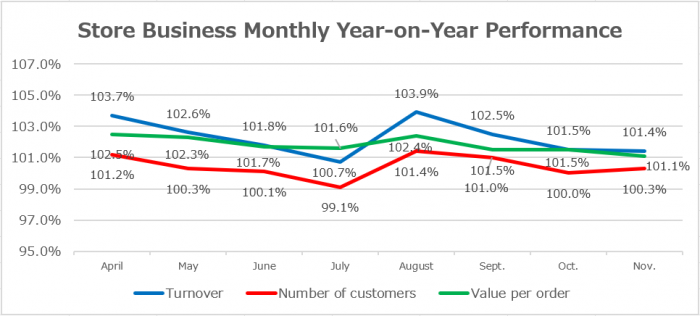

Store Business: The impact of inflation has led to an increase in per-customer spending.

The store business of consumer co-ops nationwide from April to November 2024 experienced an increase in the number of customers. This growth was driven by multiple factors, including increased foot traffic during Golden Week and Obon holidays as people resumed outings after the pandemic. Additionally, the rise in inbound tourists further contributed to the higher customer count. Moreover, demand for disaster preparedness products surged due to earthquakes, typhoons, and heavy rains, leading to an overall increase in store visits.

At the same time, rising raw material and energy costs resulted in higher food prices, which, combined with the extreme summer heat driving demand for seasonal summer products, led to an increase in per-customer spending (turnover: 102.1% y/y, per customer spending 101.9% y/y, number of customers 100.3% y/y, number of purchased items per customer 98.7% y/y).

The number of new store openings was limited to only four due to challenges such as rising construction costs and difficulties in securing prime locations for new stores. To strengthen store operations and improve customer convenience, several measures were implemented. The fresh food sections were strengthened and expanded to attract more shoppers. In response to the growing demand for convenient and easy-to-use products, the selection of prepared meals and frozen foods was expanded. To address the ongoing staffing shortages, self-checkout systems (both full and semi) and automated ordering systems were introduced to improve efficiency. Additionally, "Home Delivery Stations" were established in existing stores, allowing customers to pick up home delivery orders in-store, enhancing convenience and encouraging more store visits.

JCCU: Total supply volume reached 339.4 billion Japanese Yen, a 100.8% year-on-year increase (April - December 2024)

The total turnover of JCCU was 339.4 billion Japanese yen (100.8% y/y), surpassing the previous year's results. The turnover for the CO・OP Brand Products Business amounted to 271.9 billion Japanese yen (101.4% y/y).

The Carrot Business, which primarily supplies NB (national brand) household and consumable goods, recorded a turnover of 25.2 billion Japanese yen (100.3% y/y).

Additionally, the Catalog Business, which provides apparel and other products, recorded a turnover of 39.1 billion Japanese yen(97.7% y/y), while the Gift Business had a turnover of 2.9 billion Japanese yen (97.6% y/y).