JCCU FY2021 business results and FY2022 policies

2022.07.19

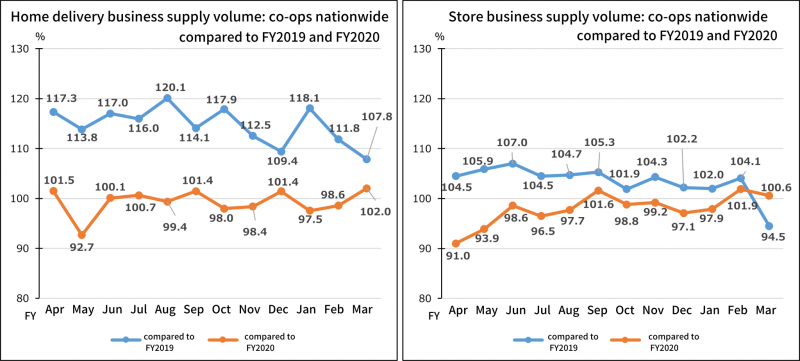

- Community-based consumer co-ops: FY2021 supply volume maintained growth compared to FY2019, the year before the COVID-19 pandemic.

- Community-based consumer co-ops: Policy for FY2022 formulated

- Home delivery business renovation (reinforcement)

Strengthen digital communication via SNS and the web to promote subscriptions, especially among young people. Strive to maintain and increase per capita usage by implementing recommendations and proposals derived from member data and improving the ordering website and apps. - Making the store business profitable

Aggressive renovation of stores to make them more attractive. Respond to the low-priced consumers by strengthening the lineup of convenience and ready-to-eat foods, such as side dishes and frozen foods, which are in increasing demand.

In addition, stores will be developed by leveraging the comprehensive strengths that only a co-op can offer, such as cooperation with the home delivery business and contribution to the community through shopping support. Also, consideration will be given to new pick-up methods, such as home delivery stations, drive-throughs, and online supermarkets. - Creating attractive products and quality assurance

Under the slogan "CO・OP Brand Products to be No. 1 in taste and health," product development and improvement efforts will continue in response to members' voices such as "I want to reduce salt intake," "I want to take in dietary fiber and protein."

Efforts will also be made to strengthen the ethical response of co-op products as well as time-saving products, for which demand from co-op members' is increasing. Furthermore, initiatives will be undertaken to create distinctive products that contribute to the local agriculture and livestock industry. - Digital transformation of business and activities through ICT

We will proceed with the demonstration tests and introduction of the DX-CO・OP Project, a cross-sectional initiative of co-ops, at local co-ops, and study the issues to be addressed in order to expand the project nationwide.

Promote the study of specific measures to reduce costs and promote future development by renewing and jointly sharing information system infrastructure among co-ops nationwide.

Co-op nationwide will take on the challenge of creating collaborative platforms in the following four areas: (1) OA communication, (2) information (products and customers), (3) business systems, and (4) system infrastructure.

- Total membership of consumer co-ops nationwide, including health and welfare and school co-ops, reaches 30 million for the first time

- JCCU maintains growth with a total supply volume of 432.9 billion yen (98.4% and 110.3% compared to 2020 and 2019, respectively)

|

JCCU

2021 Cumulative Results |

|||

|

JCCU |

Total supply volume |

432.9 billion yen |

(98.4% compared to 2020 and 110.3% compared

to 2019) |

|

CO・OP Brand Product business |

supply volume |

338.3 billion yen |

(99.4% compared to 2020 and 109.3% compared

to 2019) |

|

Carrot business |

supply volume |

36.9 billion yen |

(91.4% compared to 2020 and 110.8% compared

to 2019)

|

|

Catalog business |

supply volume |

54.0 billion yen |

(97.3% compared to 2020 and 116.3% compared

to 2019)

|

|

Gift business |

supply volume |

3.6 billion yen |

(103.0% compared to 2020 and 121.7% compared

to 2019) |